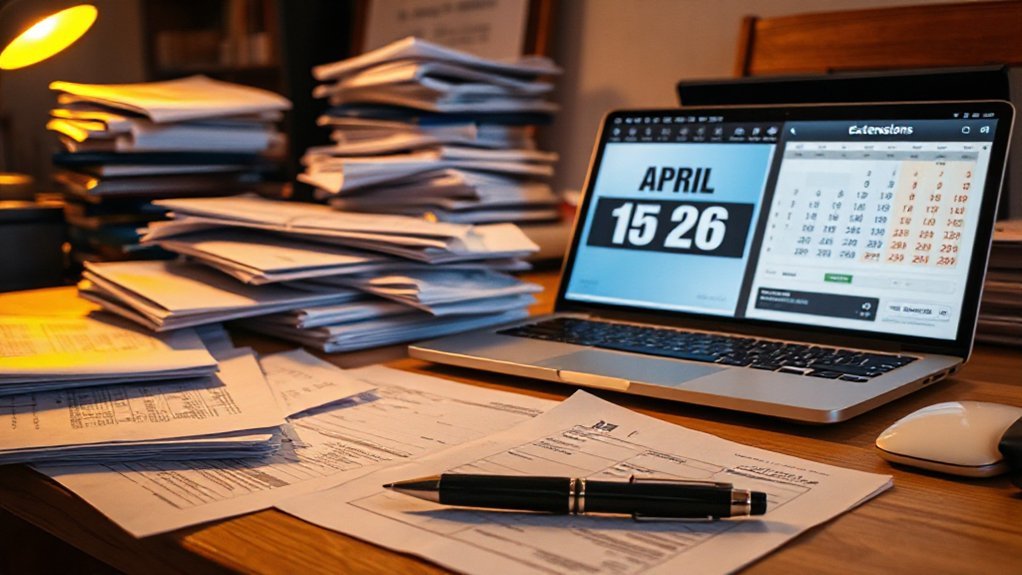

As sure as cherry blossoms pop in April, your Tax Day lands Wednesday, April 15, 2026. E-file by midnight in your time zone, or get it in the mail with an April 15 postmark. I’ve procrastinated too, but you don’t have to. Wonder if you get extra time—overseas, military, or hit by a disaster, maybe a local holiday? Stick with me for the exact breaks and the easy steps to dodge penalties.

The Federal Filing Deadline for 2026

By mid-April, the clock gets loud: the federal tax filing deadline for 2026 is Wednesday, April 15. That’s your Due Date for the 2025 Tax Year, the finish line you can actually reach without drama. Mark it, circle it, set two reminders. File by midnight local time if you e-file; if you mail, make sure the postmark says April 15. You want proof, you want peace.

Start earlier than feels comfortable. Gather W‑2s, 1099s, receipts, the little papers that open big calm. Check your name, SSN, and bank details—small errors steal time. I’ve sprinted at 11:53 p.m.; you don’t need that adrenaline to feel alive. You need margin.

Work in sprints: thirty minutes to organize, thirty to enter, then a breather. Ask, what’s missing, what’s next, what’s done. Keep it moving, keep it light. Because freedom isn’t luck, it’s habits, and April 15 is your practice place today.

Who Qualifies for an Automatic Extension

Even if April 15 feels like it’s closing in, some people get breathing room automatically. If you’re stationed overseas, you’ve got space: expat citizens and military personnel outside the U.S. generally receive an automatic two‑month filing extension. No form, no plea—just note it on your return and pay any tax due. Serving in a combat zone? You get more time, often 180 days after you leave the area, and interest and penalties pause on returns and payments that qualify. If a federally declared disaster hits your county, the IRS usually extends deadlines.

You still need to pay what you owe to avoid interest, but filing can wait. Claim the time, use the time, protect your peace. I know the pressure—I’ve stared down the clock, too, heart racing, coffee cooling. Breathe, then act. Mark your calendar, gather documents, set a plan. Freedom loves structure, and you can build both.

State and Local Holidays That May Shift Deadlines

Though April 15 feels carved in stone, state and local holidays can nudge your deadline—and sometimes move it more than you expect. If your state observes Municipal Holidays that close offices or banks, the IRS may treat the next business day as timely. Think Patriots’ Day in Maine and Massachusetts, or Emancipation Day in D.C., which has shifted federal timing before. You get breathing room, not a free pass.

Check your state revenue department and your local clerk; note Court Closures, mail pickup changes, and bank hours. File electronically when you can, but if you mail returns or payments, confirm whether a postmark on the next day still counts. I double-check drop box schedules because I’ve been burned—standing there at 5:02, envelope in hand.

Plan backward. Set two reminders, then one more. Ask: what closes, when, and how does that push me? Protect your time, protect your refund.

Disaster Relief Extensions and Special Circumstances

Holidays can nudge the calendar, but disasters can stop the clock—and the IRS knows it. When storms, fires, or quakes hit and Presidential declarations follow, the IRS usually grants automatic postponements for filing and paying. If your address sits in the declared area, you qualify; if you’re an aid worker or have records trapped in the zone, you might qualify too. Deadlines move, penalties pause, interest may still tick after the new date.

You also get practical breaks. Need to rebuild? You can claim Casualty deductions on losses not covered by insurance, and you may choose the prior year to speed a refund. Keep photos, adjuster reports, and receipts; I’ve scrambled for those files before, and the paper trail saved me. Check the IRS disaster page for your county’s dates, then breathe. You’ve got room to repair, regroup, restart—without surrendering your peace or your plan. You’re not alone.

Key Tips to File On Time and Avoid Penalties

Because small habits beat last‑minute heroics, start early and stay simple. Build a weekly five‑minute ritual: toss receipts in one folder, snap photos, label them. Keep Organized Records by category—income, deductions, credits—so you can file fast and breathe easier. Set a reminder for every paycheck: review withholding, note gaps, adjust. If you’re self‑employed, automate Estimated Payments quarterly; I’ve missed one before, and the penalty sting still motivates me.

Use a real calendar, not just hope. Mark Tax Day, mark the extension deadline, and backdate two buffer checkpoints. File electronically, choose direct deposit, and turn on two‑factor logins. When documents arrive, open them the day they land—W‑2, 1099, 1098—then check names and Social Security numbers for typos. Don’t wait on a perfect number; start with a draft, then refine. And if life gets noisy, file an extension, pay what you expect, and protect your freedom from avoidable fines today.