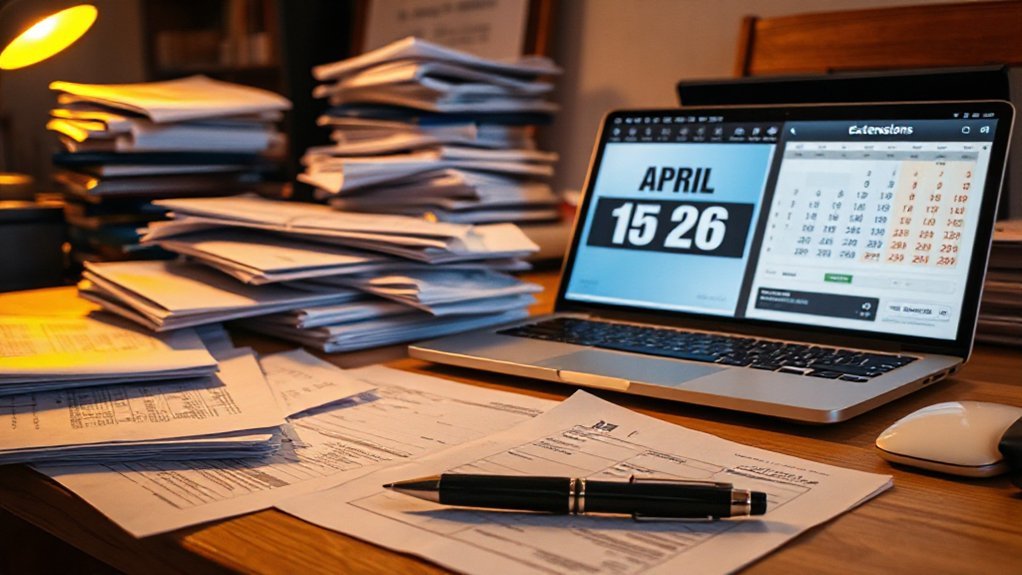

So, when is Tax Day in 2026? It usually falls on April 15, but this year, you’ll want to mark your calendar carefully—because weekends, holidays, or unexpected disruptions can shift things slightly. Missing that deadline means penalties and interest start piling up. Want to get ahead? We’ll walk through the key dates, what might change, and simple steps to stay on track without the last-minute scramble—because being prepared beats stressing later. Ready to get started?

The Standard Deadline for 2026

For most of us, the standard deadline for filing our 2026 tax returns falls on April 15th—that’s the usual cut-off date when Uncle Sam expects our paperwork in hand.

This deadline isn’t just a date; it’s a symbol of our civic duty, a moment to fulfill a responsibility that keeps our government running.

It’s a reminder that paying taxes is part of the social contract, a way we contribute to things like roads, schools, and safety.

Missing it can lead to penalties, interest, or the hassle of filing late, so staying on top of this date is essential.

It’s not just about avoiding fines, but also about embracing our role as citizens. Think of it as a small act of patriotism—some paperwork, some deadlines, and a lot of pride in doing the right thing.

Factors That Might Affect the Date

Several factors can shift the tax deadline from its usual spot on April 15th, and it’s important we stay ahead of these changes.

Natural disasters, like hurricanes or floods, can delay IRS operations or disrupt mail delivery, which might push the deadline back.

The IRS’s staffing levels also matter. If they’re overwhelmed—say, because of an influx of returns or budget cuts—processing times slow, and extensions could come into play.

Sometimes, unexpected events like power outages or system outages interfere too.

When the IRS faces these hurdles, they typically announce official postponements, sometimes on short notice. That’s why it’s smart to stay updated through IRS alerts, news sources, or our office guidance.

Being proactive helps us avoid scrambling at the last minute. So, whether Mother Nature throws a tantrum or staffing levels dip, knowing these factors helps us plan better. Stay flexible—tax deadlines aren’t always set in stone!

Recognizing Holidays and Weekends in 2026

In 2026, recognizing which holidays and weekends could impact the tax deadline is essential for staying on schedule. Calendar adjustments happen when weekends push dates into the next week, and observance variations mean some holidays might shift or be celebrated on different days.

For example, if a holiday falls close to April 15, it might move the tax deadline or create delays. Many holidays—like Memorial Day, Labor Day, or Independence Day—occur on fixed days, but others, like Easter or Passover, vary yearly.

Weekends are easy—they always fall on Saturday or Sunday, potentially leading to a deadline extension if the date lands on a weekend. Keeping track of these specifics helps avoid surprises.

Possible Extensions and Changes

As we look ahead to 2026, we’ve to ask: will the government extend deadlines again, or change the rules altogether?

Potential legislative impacts could shift tax filing dates, maybe even create new procedures we’ll need to follow.

It’s important we stay alert, because big changes could happen close to tax season—are we ready to adapt?

Future Tax Filing Deadlines

Looking ahead to tax season in 2026, we might see some changes and extensions to the usual deadlines — and yes, that’s good news for many. Technological innovation keeps pushing boundaries, making filing easier and faster, which could lead to more flexible deadlines. Taxpayer behavior is also shifting; people are more proactive and expect accommodations, especially with new apps and digital tools that simplify the process.

These changes might mean a later date for filing or even different deadlines for certain groups, like small businesses or digital nomads. We’ll need to stay alert, watch for announcements, and adapt quickly.

After all, if technology makes things smoother, why stick to rigid schedules? It’s about working smarter, not harder, and easing tax-season stress.

Potential Legislative Impacts

Changes in legislation can shake up the tax deadline landscape faster than we expect.

New policies often come with shifts in audit funding, which means more resources for IRS audits—sometimes making audits more frequent or intense. That can raise compliance costs for everyone.

If Congress decides to extend or modify the tax deadline, it could be driven by efforts to ease taxpayer burdens or to address budget needs, but it also might stumble into stricter enforcement.

We’ve seen how small changes ripple through the system, affecting how we plan our filings and prepare financially.

So, yes, legislative updates can be unpredictable, but they also present opportunities. Staying informed and flexible helps us adapt, no matter how the rules evolve.

After all, change is the only constant in tax land.

Important Dates to Mark on Your Calendar

Mark your calendars now—Tax Day 2026 is scheduled for April 15th, but don’t forget about key extension dates like October 15th if you file late.

It’s clear deadlines can sneak up on us, so it’s smart to set reminders for these critical points.

Staying on top of these dates keeps stress down and returns on track, so let’s get organized early!

Filing Deadline Details

The key to avoiding last-minute stress is knowing exactly when your tax return is due. For 2026, the deadline is April 15, but if that date falls on a weekend or holiday, it might shift slightly—so double-check!

Make sure you have your document checklist ready—W-2s, 1099s, receipts, and any other essential info.

Using reliable filing software can make the process smoother, guiding you step-by-step and catching errors.

Don’t wait until the last minute; give yourself plenty of time to review everything. Filing early isn’t just about reducing stress—it’s about avoiding those last-minute panic attacks or missing deadlines altogether. Mark this date NOW, set reminders, and start gathering what you need. It’s better to be done and dusted early than scrambling at the eleventh hour.

Important Extension Dates

Since April 15 isn’t just the finish line for filing your taxes—it’s also the starting point for extensions—we need to keep some key dates in mind.

First, remember that the IRS allows a federal extension of six months, moving the deadline to October 15, 2026.

But don’t forget, many states have their own rules—state extensions matter, and their deadlines can vary.

Some offer automatic extensions when you file the federal one, but others require separate requests.

Plus, if you’re planning to file late, be aware of calendar alignment—missing an extension could mean penalties.

Mark these dates on your calendar now, so you stay ahead, avoid surprises, and keep everything ticking smoothly.

Stay organized, stay relaxed!

Penalties for Missing the Deadline

Missing the tax deadline can pack a punch if you’re not careful. The IRS doesn’t take kindly to late filings — penalties kick in fast. Penalty calculation depends on how late you’re and how much you owe.

Usually, there’s a penalty of 0.5% of unpaid taxes for each month you’re late. That can add up quickly! Plus, interest accrues daily, making your debt grow.

So, when the IRS says “pay up,” they mean business. The longer you delay, the higher your bill, with penalties and interest stacking like building blocks.

If you can’t pay everything at once, it’s better to file on time and set up a payment plan. But honestly, ignoring the deadline? Not a good idea. Stay aware of these consequences so you don’t find yourself drowning in fines. Penalties and interest aren’t just numbers — they’re a real, tangible reminder to stay on top of tax deadlines.

Tips to Prepare in Advance

Preparing for tax day might feel overwhelming, but a bit of planning can make all the difference.

First, organize your documents now—think W-2s, 1099s, receipts, and bank statements. Keep everything in one folder or digital file so nothing gets lost.

Next, focus on expense tracking. Record every deductible expense—business trips, home office supplies, charity donations. It’s easy to forget, especially when there’s a new coffee purchase or a gas receipt.

Use apps or spreadsheets to make this quick and simple. Set aside time each week to review your records; don’t wait until the last minute.

Also, double-check your math and make sure all documents match your statements. Trust us, being proactive saves stress—and money.

The goal? Have your ducks in a row well before April 15. Better prepared than scrambling at the last minute, right? Planning now makes tax day a breeze, not a burden.

Conclusion

So, mark your calendars for April 15, 2026. That’s your official Tax Day—no excuses, no delays. Need extra time? October 15 gives you that six-month extension, but don’t wait until the last minute. Preparing now means fewer stress and avoided penalties. Double-check your W-2s, receipts, and records. Stay alert for any IRS updates, and consider electronic filing. Staying proactive makes tax season smoother, I promise—so be ready, stay organized, and file on time!